There are many myths out there about retirement planning, but until you’re of retirement age, it may be hard to distinguish fact from fiction. That’s why we’re here to dispel three of the most common myths we hear from clients and give you helpful steps for planning a happy retirement.

Myth #1: I don’t have a plan for living until I’m 100!

There's good news and bad news here. The good news is we're living longer, higher quality lives than we used to. The bad news is we're underestimating the risk of running out of money in retirement because we’re living longer than we planned.

There are really only two possible outcomes when it comes to your retirement portfolio:

You will outlive your portfolio.

Your portfolio will outlive you.

One of the primary determining factors for which outcome you are likely to experience is life expectancy. Most people don't understand just how long they might live, and if they're married, they might not know their joint life expectancy can be even longer.

Let's talk a little bit about how long you might live. Although it seems to defy common sense, the older you are, the longer you are expected to live. This is because the older you become, the fewer years that you risk dying.

Additionally, you must consider joint life expectancy. Joint life expectancy is the combined likelihood that either you or your spouse will survive to a particular age. Since you both have a chance to live to a particular age, those chances are combined using statistical math to estimate the likelihood that one of you will live to that particular age.

Below is a chart created using life insurance actuarial data for a "preferred" rated non-smoking couple at age 70. In the chart, the probability of the husband living to a particular age is shown on the horizontal axis as represented by the blue bar, the wife’s is represented by the orange bars, and the probability that either one of them will live to a particular age is represented by the green bar.

Chart 1

If you're in decent health and are nonsmoker, you can see that there is a 50% chance of one of you living to age 97. You can see that there's a 20% chance of one of you living to the age of 103! Moreover, every decade that passes sees even longer life expectancies due to better quality living and advancements in medical care.

There are a few good life expectancy calculators you can use to estimate for yourself:

Livingto100.com is based on data from the New England centenarian study, the largest study in the world of people who live to 100. It asks you almost 50 questions to determine how long you might live and it gives you important, personalized feedback on each data point affecting your longevity.

This Northwestern Mutual lifespan calculator is an office favorite: your estimated longevity is updated every time you answer one of the 14 questions on this easy-to-use life expectancy calculator. This is great feedback for seeing how your lifestyle and health factors affect how long you're expected to live.

MetLife Longevity Calculator is bare boned and is great for calculating joint life expectancy without having to do the probability arithmetic yourself. You’re given a percentage chance of living to different ages which can be an interesting exercise for couples.

Before taking the plunge and deciding to retire, it makes sense to consult a financial planner that can evaluate your circumstances to make sure that you will have enough money to last through a retirement that may be longer than you think.

Myth #2: I should start taking social security as soon as I’m eligible.

In a recent Charles Schwab survey, more than 50% of respondents thought that retirees should begin reaping the benefits of their social security checks as soon as possible.

This is, perhaps, the most dangerous and pervasive retirement myth. If you are a healthy 62 years old, it's possible that you could be receiving social security benefits for more than 30 years. Each year that you delay taking benefits after the age of 62, your monthly benefit under social security increases approximately 8%.

For example, if you claim social security at the age of 62, you will only receive 75% of your full retirement age benefits. This may seem like a big percentage, but remember, you're losing 25% of your full retirement age benefits for the rest of your life. Those dollars really add up in the long run. Additionally, for each year after full retirement age that you delay claiming social security, you'll receive an 8% increase over your full retirement age benefits. Remember, full retirement age can be 66 or 67 depending on when you were born. That means you can add between 24% and 32% to your full retirement age benefits, and who doesn’t love more money?

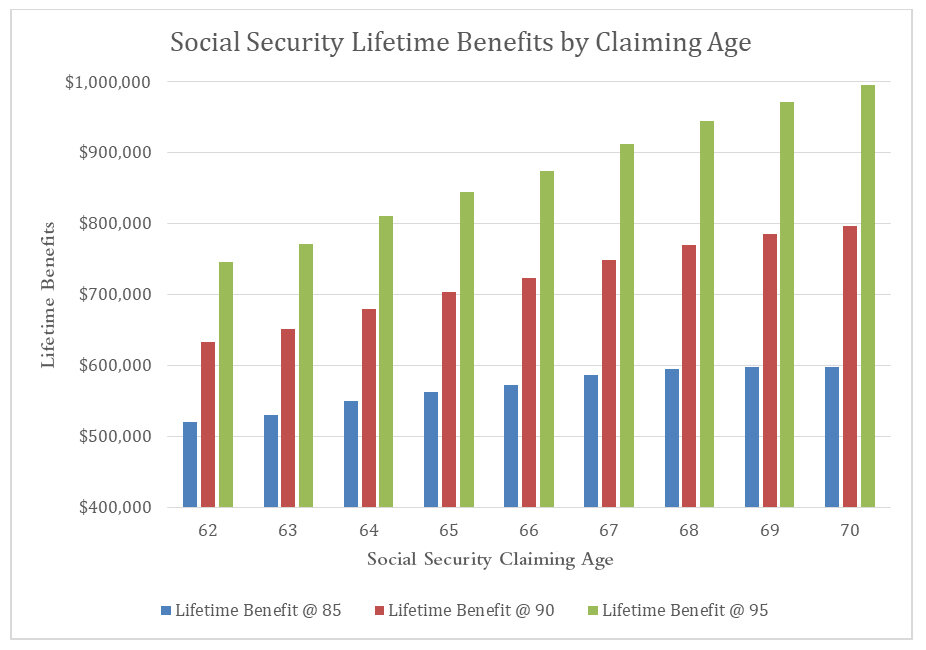

Take a look at the chart below showing social security lifetime benefits based on when you claim social security benefits. The longer you live, the bigger the difference in lifetime benefits between claiming ages. If you were to claim social security starting at 62 and end up living until 95, you'll miss out on more than $200,000 of social security benefits - in today's dollars.

Chart 2

Making matters even more difficult, claiming social security is notoriously complicated. There are a multitude of different, complex claiming strategies making it hard to understand which one is right for you. Before you or your spouse claim social security, we recommend consulting with a financial professional to find the best strategy for your circumstances.

There's one catch in this: you will need income in your later years to cover your cost of living expenses so that you are not forced to claim social security too early. That income can come in the form of savings, investments or even working longer. Which brings us to our next myth...

Myth #3: I Can Always Work Longer, Right?

You may have an ideal age at which you would like to retire, especially as you approach the retirement age window, but how much control will you have on when you retire? Research increasingly shows that many people retire earlier than they expect. In fact, it shows people retire about four years earlier than expected and that 48% of people retire earlier than they planned. So, when might you retire?

It turns out that the answer is 61. This is the “golden age” of retirement and people that plan to retire earlier than age 61, on average, work longer than they planned. Conversely, people that plan to retire after the age of 61 tend to retire earlier than they planned. The left chart below from Gallup compares when people actually retire (the blue line) with when they expected to retire (the red line). The Employee Benefit Research Institute (EBRI) chart on the right shows that almost 50% of people retire earlier than they expected (the green line) compared to later than they expected (the blue line).

Chart 3

Could there be a hidden danger in planning to work longer? Yes! Planning to work longer poses a real risk to your retirement: running out of money. When we plan to work longer, and defer our retirement age, we run the risk of not saving and investing enough because we expect earned income for a longer period of time. Since people tend to retire four years earlier than they planned, they may not have enough money for that earlier retirement.

If you're planning to work longer into retirement, this risk is magnified. If you're saving and investing at a lower rate because you plan to work longer, you may be forced to retire before you’ve banked enough to fund your lifestyle and retirement. This means it's probably not a good idea to defer savings or invest less than you need to because you plan on working longer.

Before you plan on working longer and deferring retirement savings, sit down with a financial planner to make sure you're not planning with information that may hurt your retirement piggy bank.

Chart 1. Life Expectancy Calculations. WealthPoint, 2019. Source material provided upon request.

Chart 2. “Social Security Retirement Benefit Claiming-Age Combinations Available to Married Couples,” https://www.ssa.gov/policy/docs/rsnotes/rsn2017-01.html

Chart 3. “The Retirement Mirage: Why Investors Should Focus Less on Timing and More on Saving.” Blanchett, David. Morningstar, 2018. https://www.morningstar.com/lp/retirement-mirage. Source material provided upon request.